Analysis of the Market Size and Development Prospects of China's Ultrafast Laser Industry in 20

Source: This website time:2021-06-15 browse:1491

Analysis of the Market Size and Development Prospects of China's Ultrafast Laser Industry in 2021

Laser is the core component of laser processing equipment, and the level of laser technology has become a key factor affecting the technical level of laser processing equipment. After going through the laboratory application stage and the industrial small-scale application stage, China's ultrafast laser will enter the industrial large-scale application stage. The industry's shipment level and market size will both grow rapidly with the development of the industry. In the future, with the support of policies, it is expected that the industry market size will continue to grow.

Enterprises related to the ultrafast laser industry: Dazu Laser, Huagong Technology, Ruike Laser, Huari Laser, Yinuo Laser, Anyang Laser, Langyan Optoelectronics, Beilin Laser, etc

Core data of this article: number of companies in the ultrafast laser industry, shipment volume of femtosecond ultrafast lasers, market size of the ultrafast laser industry, etc

Ultrafast laser refers to a laser with shorter pulse duration. Compared to nanosecond lasers, ultrafast lasers have extremely short pulse durations, extremely high instantaneous power, energy focused to a very small spatial area, and are not affected by pulse repetition frequency and average power. The beam quality remains stable.

Development status of ultrafast laser industry

Since the development of China's first ruby laser by the Changchun Institute of Optics and Fine Mechanics, Chinese Academy of Sciences in 1961, China's laser technology has also gone through a rapid development process of more than 50 years; In terms of industrialization, since the 1990s, established laser companies have entered the production of ultra short pulse lasers. In recent years, the continuous improvement of laser stability has led to large-scale industrial applications.

At present, participants in China's ultrafast laser industry are mainly divided into three categories: foreign ultrafast laser manufacturers, Chinese ultrafast laser manufacturers, and downstream laser equipment manufacturers. According to OFweek Laser Network statistics, as of the end of 2018, there were a total of 35 large-scale ultrafast laser research and production enterprises in China (excluding research institutions, cancelled or non operating enterprises), with 3 new additions in 2016, 7 new additions in 2017, and 2 new additions in 2018.

With the rapid development of the laser industry and the ultrafast laser market, the ultrafast laser industry is attracting more and more enterprises and talents to enter. According to Qichamao data, there were over 40 research and production enterprises of ultrafast lasers in China in 2020.

Market size of ultrafast laser industry

In terms of market demand for ultrafast lasers, according to the statistical data of the 2021 China Laser Industry Development Report jointly issued by the Chinese Academy of Sciences Wuhan Document Information Center, China Laser Journal, China Optical Society and other institutions, the shipment of China's pico femtosecond ultrafast lasers increased year by year from 2015 to 2020, with the growth rate exceeding 50%. In 2020, the shipment of China's pico femtosecond ultrafast lasers reached 2100 sets, with a year-on-year growth of 52.2%

报中心

报中心

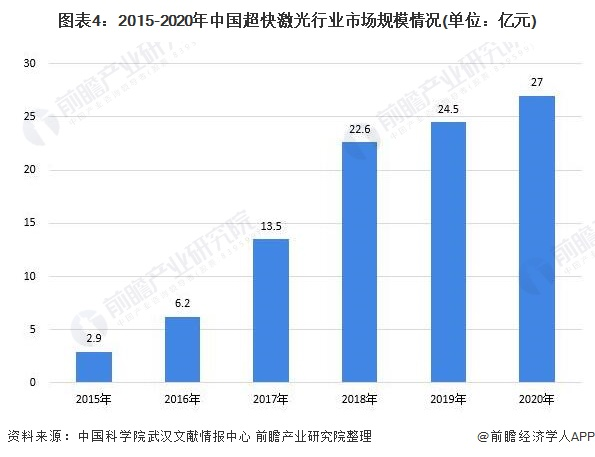

In terms of market size, according to the statistics of the Chinese Academy of Sciences in Wuhan, the sales of China's ultrafast lasers grew rapidly from 2015 to 2020. In 2020, the sales of China's ultrafast lasers exceeded 2.7 billion yuan, with a year-on-year growth of 10.20%. The average annual compound growth rate of the ultrafast laser market size from 2015 to 2020 was about 56.24%.

Prediction of the prospects of ultrafast laser industry

Laser is the core component of laser processing equipment, and the level of laser technology has become a key factor affecting the technical level of laser processing equipment; Micro processing lasers will continue to develop towards shorter wavelengths, narrower pulse widths, and higher power, and the application scenarios of micro processing will be further expanded.

The 14th Five Year Plan for National Economic and Social Development and 2035 Long Range Objectives of the People's Republic of China, released in March 2021, proposes to promote the optimization and combination of innovation systems guided by national strategic needs, and accelerate the construction of strategic scientific and technological forces led by national laboratories. Focusing on quantum information, photons and micro/nano electronics and other major innovation fields, a number of national laboratories were established, and State Key Laboratory were reorganized to form a laboratory system with reasonable structure and efficient operation.

Driven by the continuous consolidation of scientific research foundation and the expansion of demand, the market capacity of ultra short pulse lasers represented by picoseconds and femtoseconds will continue to increase. Therefore, it is predicted that the market size of China's ultrafast laser industry will continue to grow at a rate of around 15%, and it is expected that the market size of China's ultrafast laser industry will reach around 6.2 billion yuan by 2026.

For more data, please refer to the "Analysis Report on Market Outlook and Investment Strategy Planning of China's Ultrafast Laser Industry" released by Forward Industry Research Institute. At the same time, Forward Industry Research Institute provides solutions such as industrial big data, industrial planning, industrial application, industrial park planning, industrial investment promotion, IPO feasibility study, and prospectus writing.